David Auer

David AuerCPA, MS, PFS, CGMA, JD, LLM in Taxation

Over the past 28 years as a CPA and Attorney, David Auer has consulted with clients regarding complex tax, legal and financial matters including business planning and transactions; merger, acquisition, and divestiture due diligence; private equity structuring and contract negotiations; and financial, estate and business succession planning.

Mr. Auer works with a variety of clients including high net worth/income individuals and family groups; trusts and estates, and privately-owned businesses in the development, supply manufacturing, distribution, real estate, oil and gas, and professional service industries.

David obtained his B.S.B.A and an M.S. degree in Accounting from Oklahoma State University, a J.D. degree from the University of Oklahoma College of Law, and an LL.M. in Taxation degree from New York University School of Law.

He is both a Certified Public Accountant and an attorney, has the Personal Financial Specialist (“PFS”) and Certified Global Management Accountant (“CGMA”) designations from the American Institute of CPAs, and is a Fellow of the Esperti Peterson Institute and Estate and Wealth Strategies Institute at Michigan State University.

Paul Richard Brown

Paul Richard BrownPaul Richard Brown has extensive experience in litigation and commercial transactions in a wide variety of technology areas. He has conducted over 100 bench trials and numerous jury trials in various jurisdictions across the country.

He has negotiated complex multi million-dollar transactions for domestic and international high-technology businesses worldwide, including in foreign jurisdictions such as Hong Kong, Taiwan, Switzerland, Peoples’ Republic of China, Germany, Russia, Mongolia, Sweden, and The Netherlands. Mr. Brown also has experience in asset recovery and financial fraud matters, representing high net worth individuals and financial institutions.

Karen B. Brenner

Karen B. BrennerKaren Brenner is the founder of the SEC-registered independent investment advisory firm, Fortuna Asset Management, LLC (FAM). Her practice focuses on meeting the specific needs of high net worth individuals. FAM manages and executes highly individualized investment strategies for clients, including the restructuring of personal and corporate balance sheets, developing income cash flows, managing investments within estate planning structures, disposition of concentrated positions, estate tax positioning, financial and tax agreements with the IRS and state taxing authorities.

Ms. Brenner has a proactive investment management style and will seek or create appropriate investments for client portfolios. In the past, Ms. Brenner has successfully managed a hostile proxy action against an NYSE listed company, served on Creditor committees and Board of directors to effect change in the pursuit of protecting and extracting value for client investments.

In addition to her advisory firm, Ms. Brenner is the general partner or co-general partner of several limited partnerships and limited liability companies. She is an active board member of Sunlink Health Systems, Inc, a publicly traded company where she sits on the Compensation, Audit, and Executive committees. Prior to developing her investment advisory practice, Ms. Brenner was a consultant with Booz, Allen, and Hamilton in New York City.

James Burns

James BurnsJames Burns is an in-demand asset protection, estate, and tax attorney. He is the author of several books including the widely acclaimed financial book The 3 Secret Pillars of Wealth. He is Principal of The Law Offices of James Burns and CEO of White Diamond Properties, Inc. which is a real estate investment firm and has a division named White Diamond Insurance Agency.

James holds two law degrees, the advanced masters of law in tax and is admitted to practice law by the State Bar of California, U.S. District Court (Central District of California), U.S. Tax Court, and the U.S. Court of Federal Claims. He also represented clients before the IRS to their complete satisfaction and adulation. James’ legal practice is designed around real estate investors so that they reduce risk, avoid multiple probates and learn how to properly transfer their real estate holdings to the next generation free of tax and lawsuits. He also works with individuals and businesses to reduce risk and prepare for retirement using 140 different strategies that involve life insurance.

James is committed to service and started this journey when he left high school and joined the United States Marine Corps. While serving he volunteered for special operations with Marine Force Reconnaissance. Today James serves a new mission which is to eliminate retirement poverty in the United States and other countries. James is married with one son and lives in Aliso Viejo, CA.

W. Ryan Fowler

W. Ryan FowlerA graduate of Brigham Young University, Mr. Fowler is the founder and managing member of The Privacy & Financial Shield LLC (pfshield.com), and has trained, mentored, or consulted for dozens of attorneys and other professionals nationwide in regards to wealth preservation matters.

He is the author of two books on asset protection and estate planning, including the best-selling book Asset Protection in Financially Unsafe Times PDF Book(free pdf version available for members), co-authored with Dr. Arnold Goldstein. Mr. Fowler currently resides in Salt Lake City, Utah.

Robert W. Lambert

Robert W. LambertJ.D. LL.M. (International Tax) and LL.M. (International Asset Protection) Rob Lambert has a Bachelor of Arts in International Economics (summa cum laude) from Claremont McKenna College (1972); a Doctor of Jurisprudence from the University of California (1975) where he was Editor of the Law Review and President of the Moot Court Honor Board; a Masters of Law (international tax) from New York University School of Law (1976), where he received the Schwid award and Hertzfeld fellowship. He was a full time tenure track Assistant Professor in the Masters of Taxation program at USC (1978-1984).

He is a Permanent Contributing Editor of Debtor-Creditor Law published by Matthew Bender. He currently is President of Asset Protection Corporation and has completed a second LL.M. as part of the course work for his Doctorate of Juridical Science at New York University School of Law. Rob is married and resides between New York and California.

cnbc.com – The Privacy & Financial Shield LLC pfshield.com – CNN Money money.cnn.com –

John Vucicevic

John VucicevicJohn is president and founding principal of Bay City Financial, LLC in Panama City Beach, Florida. Each year, Mr. Vucicevic educates area investors by holding educational classes on financial planning open to the public. He instructs advisors and consumers locally and nationally on many topics including: Creating a private defined benefit pension from a 401k, transferring money out of IRA’s tax-free, stopping the unfair tax on social security income, how to get long-term care protection without paying annual premiums, safe investment alternatives, protecting yourself from market losses, & income for life strategies.

Mr. Vucicevic has been assisting his clients to achieve their financial objectives since 1983. He holds over a dozen licenses and designations. He is a highly sought after national speaker and has been featured within income planning articles in the Wall Street Journal, Investment News and News Max. John currently resides in Panama City Beach, FL with his wife and two sons.

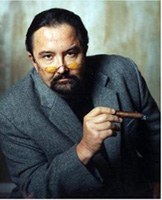

Randall Edwards

Randall EdwardsRandall K. Edwards has an undergraduate degree in journalism from Brigham Young University (1979) and graduated from the University of Utah College of Law in 1982. He is actively licensed to practice law in the states of Utah, Nevada, California, and Arizona, with his primary office located in Salt Lake City, Utah. Mr. Edwards is also the United States affiliate correspondent for the firm of Gaia, Silva, Gaede & Associados, a national Brazilian law firm with offices in Sao Paulo, Rio de Janeiro, Brasilia, Curitiba and Belo Horizonte.

Mr. Edwards has substantial experience in transactional and litigation matters. He currently represents various domestic and international clients in business planning, asset protection, estate planning, and litigation. In that capacity, Mr. Edwards tried a three-month case in San Jose, California in 2007, on behalf of a Brazilian software distributor, which resulted in a sizeable confidential settlement. His current caseload includes the representation of American companies that have undertaken mining and other business operations in Latin America, the representation of medical doctors in medical malpractice actions, the representation of injured persons in personal injury claims, and advising individuals and families on estate and asset protection planning.

Mr. Edwards believes that the best transactional lawyers (planners, negotiators and corporate advisors) also litigate cases because they know how their plans and documents will stand up in the crucible of litigation. Conversely, the best litigators also have experience planning, writing and carrying out complicated legal transactions, because that experience helps them to be more effective in explaining business, corporate and financial concepts to judges and juries who may have little understanding of the day-to-day world of business management and functions.

Mr. Edwards has lectured extensively in the United States and internationally (Canada, Mexico and Brazil), in academic venues and in private seminars, on various aspects of domestic and international law. Mr. Edwards is fluent in Portuguese and Spanish, in addition to his native English. Mr. Edwards has published articles for the American Bar Association and other organizations, some of which may be found on his website.