I’m going to talk today about how to use limited liability company (LLC) for estate planning. Now, the most common type of business entity used for estate planning is what’s called the FLP which is short for a Family Limited Partnership and FLP is really just a normal limited partnership that is used in an estate planning context.

You can actually use a limited liability company (LLC) in the same way and we call these Family Limited Liability Companies, FLLCs and use them just like FLPs except there’s more flexibility with a limited liability company (LLC). If you don’t know how an LLC is more flexible than a limited partnership.

I recommend you watch the free video on this site called LLC basics and it’ll tell you why LLCs are more flexible and oftentimes preferable to an FLP.

So, me as a single person, I can make five gifts of $13,000 each to five different people. If you’re a married couple, you can do a split gift. You can combine it so each of you gets a $13,000 tax-free ability to make gifts up to $13,000. So, you can do a split gift. You can double that and now make gifts of $26,000 to each of your children. But you’re not gifting the assets in the limited liability company (LLC) your children.

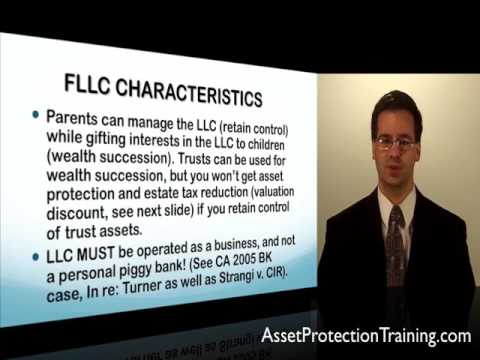

You’re gifting the ownership interest in the limited liability company (LLC) to the children, and the assets stay safely in the LLC where the children can’t control those assets. You have someone else who’s a manager.

Just like when you use a trust, someone else is a trustee and then they manage that for the beneficiaries, your heirs or your children so that the children can’t just squander the assets and that’s, you know, why trust are often used for estate planning. You get something similar in LLCs except with an LLC, the parents can retain control over the limited liability company (LLC). With the trust, the parents have to give the asset away to trust and you have this other trustee that manages it.

If you’re just doing a living trust and you’re just trying to avoid probate, you can stay in control; but if you want any type of estate tax savings; if you want any type of asset protection; if you use a trust then you have to give up control of that asset to someone else with the trust with LLC while you’re alive, you can stay in control, and you can get some reduction in estate tax liability with your family LLC just like with a Family Limited Partnership. We call that – we use what’s called that valuation discount. We’re going to talk about that shortly, to see how you can reduce your estate tax liability by putting assets into the limited liability company (LLC).

Your limited liability company (LLC) must be operated as a business, not as a personal piggy bank. There’s a big landmark case, it came out – well, there’s this 2005 California bankruptcy case called In re Turner, the judge basically says listen LLCs, limited partnership corporations, they’re business entities.

If you just put assets in there and there’s no business purpose, you just put your personal vacation home or your personal residence or just your cash bank account into the limited liability company (LLC) just to shield it from creditors or for estate planning; but you take the money out all the time to pay for your personal expenses instead of taking out profits as a normal business would, you take profit. You’re just paying your car payment directly out of the LLC bank account, or it’s just a strictly personal asset like your home. You’re not using your limited liability company (LLC) in a business context and the creditor is going to pierce it, and this case, Strangi versus CIR, that was a Family Limited Partnership.

That was a partnership used for estate planning, but they use it improperly and this is one of the things that they did. They used a limited partnership like a piggy bank. There’s no purpose for it and it failed to provide estate tax savings.

Now, let’s talk – this is the number one tool you use, FLPs and FLLCs to reduce the amount of your taxable estate so that you pay fewer estate taxes. Now right now 2011, 2012 you only pay in estate tax. If at the time you die your estate is worth more than $5 million, there’s a tax of 35% on anything over that.

However, that’s only for two years. President Obama cut a special deal with the Republican Congress so he can get certain laws passed and he said, “Well, if you do that, then I’ll give this special estate tax for two years”. It’s basically so that they can do all this estate planning and get all these assets outside their estate. But we have huge deficits in America. We have a huge national debt and most planners feel that most likely after this two-year period, the estate tax is going to go to a higher tax rate and it’s going to be taxed on a lower threshold.

Now, in the past, the estate tax was as high as 55% on any wealth over a million dollars, and so using a family LLC to reduce that estate tax liability, it’s an excellent tool if you do it right.

What happens is if you take some assets and you put them into the limited liability company (LLC), you no longer own those assets but what you get back is an ownership interest in that LLC. Well, that ownership interest in the LLC for estate tax purpose, the same thing with a limited partnership, is usually considered worth 20 to 50% less than the asset that you put into that limited liability company (LLC) or limited partnership.

So, if you put a million dollars in assets into your LLC, you get your LLC interest back in exchange, but for estate tax purposes your LLC interest is only worth $500,000 to $800,000. So that reduced the amount of your taxable estate, and it provides considerable estate tax savings.

It could save you a few hundred thousand, even a few million dollars depending on how much you’re putting into the entity, what the size of your estate is.

A lot of times we use Family Limited Partnerships or FLLCs, we use them in combination with trust. Right now in 2011 and 2012, you can make lifetime gifts of up to $5 million without paying any gift tax or estate tax. Let’s say you have put assets into a family LLC. Let’s say it was a million dollars in assets but after the valuation discount, it’s only worth $700,000 now. Well, then you gift that limited liability company (LLC) interest to the trust, and when you gift it and if the trust is irrevocable and set upright, it’s no longer in your taxable estate.

Well, the limit of tax-free gifts you can make in your lifetime during 2011 and 2012 is $5 million. But what if you put, we’re able to put $8 million into a family LLC. You get a discount and takes it down to $5 million and then gift that into a trust completely outside of your estate. It basically allows you when you use those two tools together to really get some really good estate tax savings. and there are some other advanced strategies where we may be able to get on a person whose estate is worth a million dollars. We oftentimes can get their estate tax liability down to zero through using advanced tools such as the Defective Beneficiary Tax Trust.

That’s the DBETT or the IDDT, the Intentionally Defective Grantor Trust. There are other advanced tools that we combine with these limited partnerships or LLCs. We may able to get a $150 million estate down so that the estate tax is effectively zero, and we can even do it where guess what you’ll be able to retain an income stream from that trust.

So, you can give the assets into these advanced trust structures, but you use that in combination with the limited liability company (LLC), you get great asset protection, great estate planning, you can do larger gifts than ever before. You can even retain an income stream during your lifetime from those assets you gave away with these advanced strategies, the FLLC with the DBETT or IDDT and you get great estate planning. You get great asset protection by using these tools.

So, that concludes this discussion on the FLLC and the valuation discount. I hope you found it helpful.

More information on FLLC: